As many will attest, California is a beautiful state with much to offer. However, it is also one of the most expensive states. Among other factors, the high taxes and the overall high cost of living have often been cited as reasons for individuals either leaving the state or seeking to do so.

If you are considering leaving the Golden State, it is essential to be aware of the potential income tax implications that may exist and the expansive reach the state has such that you may still be liable for California state income taxes, even if you are no longer a resident of the state.

Two general drivers may expose a taxpayer to California taxation – the source of income and the taxpayer’s residency status.

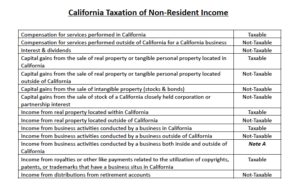

Source of Income: California imposes income tax based on the source of the underlying income, regardless of where the recipient lives. This means that income earned from temporarily working in California (while living in another state), a rental property in California, or from a business that generates income in California (or a portion thereof) is all subject to California tax. Additionally, any capital gains generated from the sale of real or tangible personal property located in California would be subject to California taxation.

Generally speaking, portfolio income from intangible assets, namely interest, dividends, and capital gains, do not possess an underlying state source and rely solely upon the recipient’s residency, as described below. This same methodology would apply to other income items, such as distributions from taxable retirement accounts or pensions, even if the deductions for contributions to or accruals occurred during California residency from services performed in California. California does not tax social security benefits by law – one bright spot given that eleven states do!

Scroll to the bottom for a handy chart describing California’s taxation of non-resident income.

Residency Status: If you are a resident of California, your worldwide income is subject to California income tax. Becoming a California non-resident is a facts and circumstances test and is more involved than simply purchasing a new principal residence in a different state. In reality, it is much more complex, and the best practice is to truly move, changing your residence, domicile, and overall life, including:

- Selling your California residence.

- Leaving California employment and earning income in the new state.

- Purchasing and spending the majority of your time in a residence in the new state.

- Establishing business and social ties (doctors, dentists, religious affiliations, etc.…) in the new state and discontinuing those in California.

- Changing your voter registration and driver’s license.

- Enroll any children in schools within the new state.

- Limiting, if not ceasing, the time spent in California post relocation.

Assuming a taxpayer is able to establish residency and domicile in a new state, what mechanisms does the Franchise Tax Board have to assert that taxes are still liable to the state of California? Many, unfortunately.

Residency audits are the most common and have increased in frequency. In short, a residency audit involves the state of California challenging a taxpayer’s assertion that they are no longer a resident, even looking at items such as cell phone records to determine a taxpayer’s historical location and compute how many days they were in California. Additionally, legislative efforts to impose either exit taxes or overall wealth taxes have gained steam, the most recent being California’s AB 2088, first introduced in 2020. While this bill did not make it out of committee, it could easily be inferred as a precursor to the state’s intentions regarding taxation.

While moving out of California may seem like an easy solution to mitigate one’s state tax liabilities, the reality is much more nuanced and complex. Taxpayers should do their due diligence in advance and plan to severely limit, if not sever, their connections to California if possible. Budgetary issues and an evaporating tax base lend themselves to the state being more aggressive in challenging non-resident claims and legislators installing new arduous and far-reaching tax regimes.

Frequently Asked Questions

How long do I need to be out of California to be considered a non-resident for tax purposes?

There’s no specific time requirement. It’s based on a facts and circumstances test. However, spending less than 6 months in California and establishing strong ties to your new state can help support your non-resident status.

Can I keep a vacation home in California without affecting my non-resident status?

You can, but it may complicate your situation. The more ties you maintain with California, including property ownership, the harder it may be to prove non-resident status. It’s important to limit your time in California and ensure your primary residence is clearly established elsewhere.

How does California tax retirement income for non-residents?

Generally, California doesn’t tax retirement income (like pensions and 401(k) distributions) of non-residents, even if it was earned while working in California. However, other types of deferred compensation may be taxable.

What is the “183-day rule” and how does it apply to California residency?

The “183-day rule” is a common misconception. California doesn’t have a strict 183-day test for residency. While spending more than 183 days in California can be a factor, residency is determined by a variety of factors, not just time spent in the state.

How does California’s Franchise Tax Board (FTB) determine if someone is still a resident?

The FTB looks at various factors, including the location of your primary residence, where you’re employed, where your family lives, where you’re registered to vote, and where you have bank accounts and other financial ties.

Can I work remotely for a California-based company and avoid California income tax?

If you’re a non-resident working remotely for a California company, your income generally isn’t subject to California tax. However, any work performed while physically in California would be taxable by the state.