Timing strategies have long been a staple in any tax planner’s arsenal. Often times, these strategies are focused upon the deferral of revenue or acceleration of deductions. While these tactics are typically temporary in nature, taxpayer’s can create permanent savings for themselves by utilizing the turn of the calendar to their advantage.

In generating permanent savings, taxpayers and their advisors need to be cognizant of the various thresholds that exist and come into play for various deductions and credits. Legally structuring a taxpayer’s income and deductions around these thresholds can become an objective to maximize an individual’s savings.

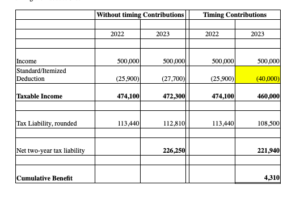

For example, let’s focus on the interplay between the standard deduction and itemized deductions. For couples filing jointly, the standard deduction threshold for 2022 is $25,900 and for 2023 it is $27,700 – meaning that if the sum of one’s itemized deductions (items like taxes, mortgage interest, and charitable contributions) does not exceed this level, by default, they would be afforded the standard deduction. But what if one is close to the threshold level? Can we “group” more itemized deductions into one tax year?

Assume the following fact-pattern:

- A couple files married filing jointly and annually has gross income of $500,000

- The couple’s annual deductions include $10,000 for state and local taxes (the Federal maximum) and $15,000 in charitable contributions.

Based on this fact-pattern, the taxpayer would have an annual gross income of $500,000 and be afforded the standard deduction each year, given their itemized deductions do not exceed the standard deduction threshold. But what if they grouped their charitable contributions? Instead of making donations towards year end around the holiday season, the taxpayer should defer their usual 2022 contributions to January 2023 and then still make their usual 2023 contributions in December 2023. This would afford them the standard deduction in 2022, which they would have received anyways, and afford them itemized deductions of $40,000 for 2023. This slight tweak would net them a permanent Federal tax savings of over $4,300 as outlined below, simply by timing their deductions.

While the previous example intuitively makes sense, there are other times when the default thought may actually not be in a taxpayer’s best interest. Take for example someone who will experience both a one-time income event (such as a bonus) and also a large, deductible, out of pocket medial bill. While the general thought may be to match the deduction in the year of the large income event to minimize the tax impact, depending upon the numbers involved, this may not be the most beneficial outcome.

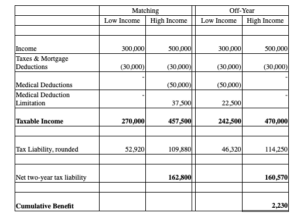

Assume the following fact-pattern:

- A couple files married filing jointly and annually has gross income of $300,000

- The couple’s annual deductions including $10,000 for state and local taxes (the Federal maximum) and $20,000 in mortgage interest.

- The couple is planning to incur $50,000 in deductible, out of pocket medical costs

- The couple is anticipating receiving a one-time income event of $200,000

Based on this fact-pattern, the taxpayer is actually better off incurring the medical expenses in the off-year of the income event. The reason for this, utilizing these numbers, is due to the limitation imposed on medical expenses. Medical expenses are only deductible to the extent they exceed 7.5% of a taxpayer’s adjusted gross income. Accordingly, had the taxpayer matched the income event and medical costs in the same period, they would be moving that medical deduction threshold higher, limiting the extent of the medical deduction they would receive. The difference achieved utilizing our hypothetical fact pattern was enough to overcome the overall increase in tax on the higher income.

With tax planning always at the forefront, the immediate thought of accelerating deductions and deferring revenue, while a good rule of thumb, should be placed into the specific context of each individual taxpayer. Small tweaks and minor adjustments, with proper foresight and analysis, can create permanent tax savings that would otherwise be overlooked and missed.

Frequently Asked Questions

How far in advance should I start planning my tax strategy to take advantage of timing differences?

It’s best to start planning at least 3-6 months before the end of the tax year. This gives you enough time to analyze your financial situation, project your income and deductions, and make informed decisions about timing your expenses or income.

Are there any risks or potential downsides to grouping charitable contributions in one year?

While grouping can be beneficial, it may limit your ability to itemize deductions in the alternate year. Additionally, it could impact your cash flow if you’re making larger donations in a single year. Always consider your overall financial situation before implementing this strategy.

Can this strategy of timing deductions be applied to other types of itemized deductions besides charitable contributions?

Yes, this strategy can be applied to other deductions such as property taxes, medical expenses, or mortgage interest payments. However, some deductions have specific timing rules, so consult with a tax professional before making any decisions.

How does the Alternative Minimum Tax (AMT) affect these timing strategies?

The AMT can potentially negate the benefits of some timing strategies, especially for high-income earners. If you’re subject to AMT, certain deductions may be disallowed or reduced, so it’s crucial to factor this into your planning.